How to Create a Budget with an Irregular Income

Practical steps to manage money when paychecks are unpredictable.

Why budgeting is harder with irregular income

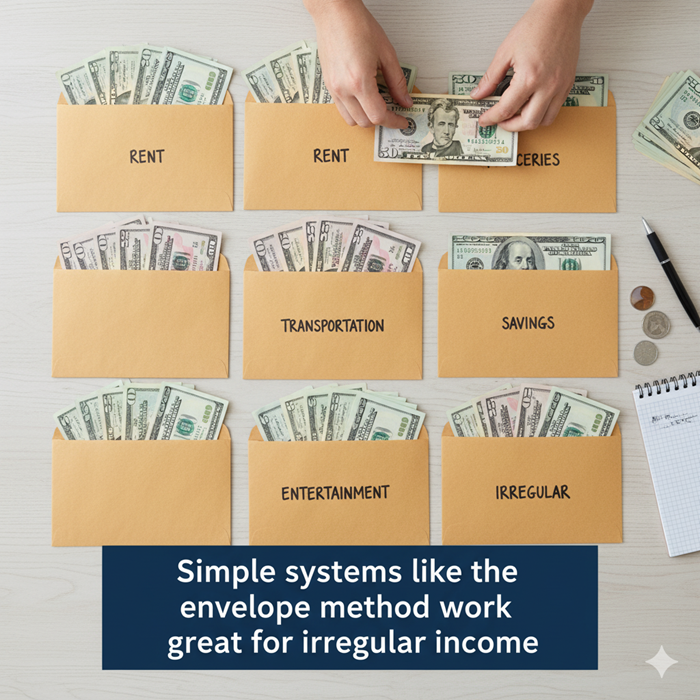

Freelancers, gig workers, and entrepreneurs often face the challenge of unpredictable pay. One month might feel comfortable, while the next feels like survival mode. Without a system, it’s easy to overspend in “good months” and struggle in lean ones.

Steps to create a flexible budget

- Find your baseline income Look at the last 6–12 months and calculate your lowest monthly income. Use this as your “safe number” when planning essentials.

- Prioritize fixed expenses Cover housing, utilities, groceries, and insurance first. These should always fit into your baseline income.

- Create a buffer fund Save extra during high-earning months. Aim for 1–3 months of expenses in a separate “income smoothing” account.

- Use percentage-based budgeting Instead of fixed amounts, assign percentages (e.g., 50% needs, 30% savings, 20% wants). This flexes with income size.

- Automate savings & debt payments Even if small, automatic transfers help build consistency and reduce stress.

- Review monthly & adjust Check in at the end of each month to rebalance categories and prepare for the next cycle.

Extra money management tips

- Separate business and personal accounts: Makes taxes and planning simpler.

- Plan for irregular expenses: Holidays, car repairs, or medical bills are easier with sinking funds.

- Live on last month’s income: Use this month’s earnings for next month’s expenses if possible.

- Track every dollar: Apps like YNAB, Mint, or even a spreadsheet help keep spending aligned.

FAQs

What if I earn less than my baseline in a month?

This is where your buffer fund comes in. Withdraw from it to cover essentials, then refill it in higher-income months.

Should I cut back on “wants” completely?

Not at all. Just scale them according to your income. When pay is high, enjoy responsibly. When low, keep it minimal.

How big should my buffer fund be?

Start with 1 month of expenses. Ideally, build toward 3–6 months to handle slow seasons without stress.